IMPORTANT MESSAGE – PLEASE READ

Concurrent with the release of its 2023 status report on October 12, 2023, the TCFD has fulfilled its remit and disbanded. The FSB has asked the IFRS Foundation to take over the monitoring of the progress of companies’ climate-related disclosures.

As of November 2023, this website will no longer be updated or monitored but will remain available to serve as a resource for materials developed by the Task Force. The Task Force is deeply grateful to all parties involved for their input, support, and adoption of the TCFD recommendations.

Task Force on Climate-related Financial Disclosures

Climate change presents financial risk to the global economy.

Financial markets need clear, comprehensive, high-quality information on the impacts of climate change. This includes the risks and opportunities presented by rising temperatures, climate-related policy, and emerging technologies in our changing world.

The Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosures (TCFD) in 2015 to improve and increase reporting of climate-related financial information. Following the release of the Task Force’s 2023 Status Report, upon request of the FSB, the TCFD has been disbanded.

Benefits of better disclosure

Risk assessment

More effectively evaluate climate-related risks to your company, its suppliers, and competitors.

Capital allocation

Make better-informed decisions on where and when to allocate your capital.

Strategic planning

Better evaluate risks and exposures over the short, medium, and long term.

Frequently asked questions

Organizations with public debt or equity and asset managers and owners ─ the preparers and users of financial disclosures ─ are particularly encouraged to support and implement the recommendations. Other supporters can range from industry associations, to central banks, governments, regulators and others.

Support indicates that your organization believes the TCFD recommendations provide a useful framework to increase transparency on climate-related risks and opportunities within financial markets. Because many different types of organizations support the TCFD, there are not specific requirements for each type of supporter ─ however supporting organizations are expected to encourage TCFD implementation. For companies, support is a commitment to work toward their own implementation of the TCFD recommendations. Credit rating agencies, stock exchanges, government agencies, and other types of organizations have different but equally important roles to play.

The TCFD recommendations are voluntary in nature and have been devised by the private sector ─ “by the market, for the market.” Therefore, we rely on industry support to drive adoption and implementation of the recommendations. Publicly declaring support is a natural next step for companies that are already looking into climate-related disclosure. Public support provides companies with the opportunity to communicate with investors, clients, and employees alike about how they are thinking of and tackling the implications of climate change.

Expressing support is as simple as completing the <a href=”https://www.fsb-tcfd.org/become-a-supporter/”>TCFD support form</a> with the proper approvals from your organization. There is no cost to become a supporter.

In May 2018, the TCFD launched the TCFD Knowledge Hub in collaboration with the Climate Disclosure Standards Board (CDSB). Available at tcfdhub.org, the TCFD Knowledge Hub is an online platform housing relevant insights, tools, and resources to help organizations implement the TCFD recommendations. The portal houses over 400 resources covering governance, strategy, risk management and metrics & targets. Contributors range from nonprofit organizations to intergovernmental institutions, academics, industry associations, consultants, and corporates. Additional resources are added on a continuous basis.

As an immediate step, your company name will be added to the growing list of supporters on the TCFD website. In the longer term, the TCFD seeks to continue engaging with supporting companies that are working on implementing the recommendations.

The 2017 <a href=”https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf” target=”_blank” rel=”noopener noreferrer”>TCFD recommendations report</a> and the 2021 <a href=”https://assets.bbhub.io/company/sites/60/2021/07/2021-TCFD-Implementing_Guidance.pdf” target=”_blank” rel=”noopener noreferrer”>TCFD Annex</a> provide helpful introductions to the TCFD recommendations. For more information on implementation, you can also refer to the hundreds of resources and learning courses available on the TCFD Knowledge Hub.

TCFD recommendations

The TCFD has developed a framework to help public companies and other organizations more effectively disclose climate-related risks and opportunities through their existing reporting processes.

Governance

Disclose the organization’s governance around climate-related risks and opportunities.

Strategy

Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning where such information is material.

Risk Management

Disclose how the organization identifies, assesses, and manages climate-related risks.

Metrics & Targets

Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

Read the TCFD recommendations on climate-related financial disclosure.

Supporting the TCFD recommendations

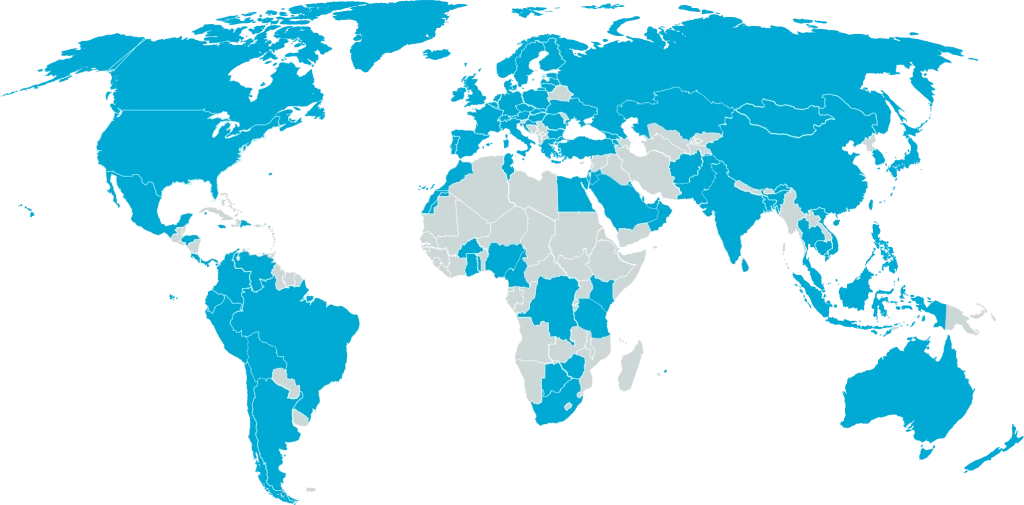

Since the launch of the TCFD’s recommendations report in 2017, nearly 5,000 organizations publicly declared their support for the TCFD’s recommendations. Support indicated that an organization believes the TCFD recommendations provide a useful framework to increase transparency on climate-related risks and opportunities within financial markets.

TCFD supporters around the world

4900 supporters in

103 jurisdictions